Pricing - How to determine the cost of your product

Pricing - How to determine the cost of your product

Pricing - How to determine the cost of your product

Want to know how to set the ideal price for your product? In this article, you will learn how prices are made up and what you need to consider in order to determine a suitable price. By the end, you will understand which factors influence prices and what the consequences are if the price is too high or too low. We look at how to analyze your costs and calculate prices in order to make informed decisions for your company.

Differentiation between price and costs

So let's take a look at costs first. Even though costs surround us every day, our understanding of them is not always as clear as that of prices. We define costs as everything that consumes value in the course of a business activity. The small but crucial difference is that costs are not only incurred when the company spends money, but also when materials or services are consumed.

Example: Fuel consumption

Let's illustrate this idea using the example of fuel for your company car. You buy the fuel at the gas station and pay money for it immediately, but you don't use it right away, only when you drive it. Of course, you have already incurred an expense when paying, but as you have also received fuel of the same value, no costs have been incurred. You can think of it as an exchange, where you have exchanged money for gasoline, but in this sense nothing has been used and you could theoretically turn the fuel back into money.

It's the same with all the other materials in our company. When we buy them, we already have to spend money, but only when we use them are costs realized. It is particularly important to understand this when there is a significant time lag between expenditure and consumption.

Example: Annual tram pass

If you travel to work by tram instead of by car and buy an annual pass, you have to pay the full price today, but you also get a service that you use 1/12 of every month. Accordingly, the same costs will be incurred in the next 11 months as in the month of purchase, even if we don't have to spend anything more there. You could also set aside 1/12 of the price of the annual pass each month and then pay all at once, which would give you the same result.

Costs to help you decide

A clear understanding of your costs will help you make better business decisions. Without separating costs from expenses, you could misjudge the actual profit or loss in a given period.

Example: Christmas sales

Imagine your company was able to sell more than average in December due to Christmas sales, but in the same month you had to pay for all your insurance and your annual ticket for the coming year. If you did not distinguish between costs and expenses, you would not be able to understand that you made an above-average profit due to the high expenses. This is because your profit is the difference between your turnover and your costs.

This means that not only would the actual profit be incorrectly reported, but you would also run the risk of making the wrong decisions. For example, you might decide that the Christmas business isn't worth the effort and you'd rather not put yourself through the stress in future. Then you would incur the expenses for insurance and annual tickets again in December, this time without a high turnover and you would make a loss. So if you want to make financial decisions, it's important to know in which month or quarter you made which profit. Accordingly, your costs must also be allocated to the correct periods.

Tip: At this point, in all the euphoria, we must also bear in mind that although we have the option of documenting every pen as a cost, we should always ask ourselves beforehand whether it justifies the effort. Are the costs for each item large enough to be worth including in a cost calculation or can we neglect or summarize them in order to concentrate on the important cost drivers?

Determine your own costs and sales volumes

We can now differentiate between when we incur an expense and when costs are incurred. What is striking, however, is that the costs for the annual pass are incurred regardless of whether and how much we travel by tram, but the costs for gasoline consumption depend very much on whether we drive our company car or not.

Costs can be divided into two main categories:

- Fixed costs: independent of production volume or usage (e.g. rent, insurance).

- Variable costs: Dependent on production volume or usage (e.g. material consumption, electricity).

Example: Operation of a website

Let's assume you run a website on which you sell professional product reviews.

Here is a simplified and fictitious cost overview:

- You rent a server for your website, which costs you a fixed €100 rent per month.

- The server operator charges you a cost per click, which amounts to €0.01 per click including electricity consumption, maintenance and everything else.

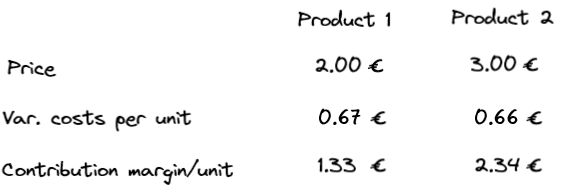

You sell professional product reviews that help companies and private individuals choose products. You have two products: 1st product: Review on “monitors that are easy on the eyes” for €2 and 2nd product: Review on “height-adjustable desks” for €3

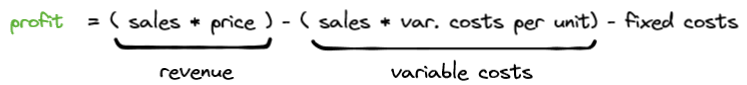

Finally, you want to know whether your prices cover all costs and what profit you can expect. To do this, let's take a look at the components that make up your profit and what our previous information tells us.

We can write this in simplified form as:

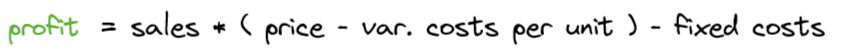

As you can see, in the profit equation, both your revenue and the amount of your variable costs depend on your sales volume. Using the website example, this sounds strange at first, as our variable costs depend on clicks and not on the number of products sold. We therefore need to relate the number of products sold to the variable costs.

First, we determine how often users click on your site on average until one of them decides to buy one of your products. As is so often the case, data about your company is essential. If you don't have this yet, you will have to look for comparable data or statistics or, in the worst case, make an estimate. However, you have cleverly integrated a web analytics tool on your website. And since you don't want to pass on your customers' data to third parties, you use a free open source version, which you can find via our search (link).

Data from the web analysis tool:

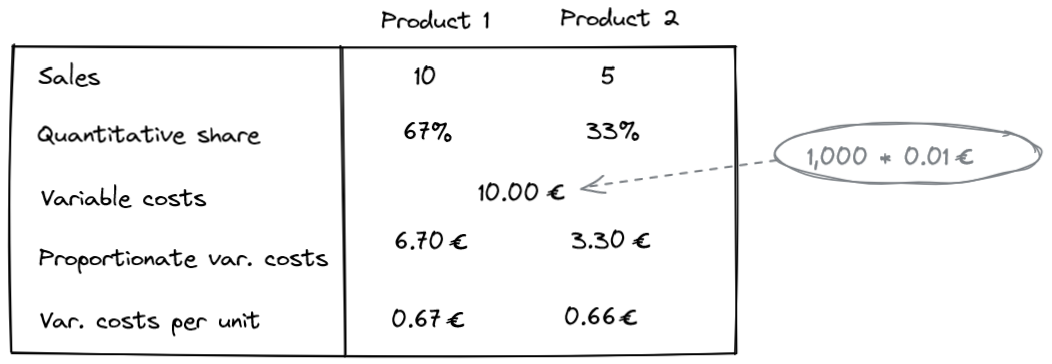

- You generate 15 sales per 1,000 clicks.

- Product 1 accounts for 67 % of sales, product 2 for 33 %.

You therefore know your sales volume and variable costs, both of which are influenced by the same reference value, namely the clicks on your website. This also allows us to calculate how many clicks it takes for a customer to buy product 1 or 2 from you and how many variable costs are incurred per unit. For 1,000 clicks, for example, it looks like this:

This results in variable costs per unit (also known as unit costs) of €0.67 per product 1 sold and €0.66 per product 2 sold. So now you know how much money it costs you on average until a customer buys one of your reviews.

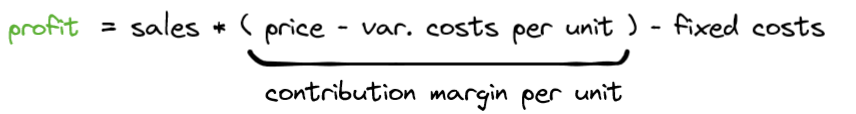

Now we subtract these variable unit costs from the sales price of our products and that almost leaves you with your profit per unit - if it weren't for the fixed costs of server rental. We call the difference between the sales price and the variable unit costs the unit contribution margin, as it indicates how much each product sold contributes to covering your fixed costs.

For our two products, the unit contribution margin is

You can also see from this that it is much more worthwhile for you to sell product 2, as it earns you more money per unit than product 1 after deducting the variable costs.

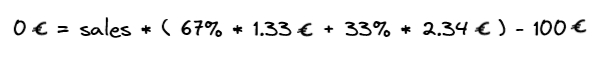

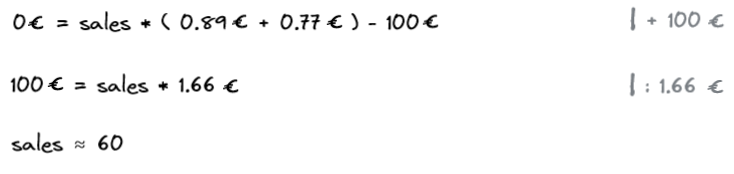

So what your products should at least cover in order not to make a loss are your monthly fixed costs for the server. But how many products do you need to sell in order to pay your server rent of €100 or, in other words, to make a profit of €0? If we insert the unit contribution margin into the profit formula from just now, we get the following equation:

If we use the €0 profit as the limit to the loss zone, the pro rata unit contribution margins of the two products and our fixed costs of €100, we get:

The only unknown in the formula is the sales quantity. If we change the formula according to this, we get the quantity of products we need to sell to cover all costs. The result here is

So you have to sell at least 60 products in total, 67% of which are split between product 1 and 33% between product 2. Since you know from your web analytics that you sell an average of 15 products per 1,000 clicks, this means that you need at least 4,000 clicks per month on your website to avoid making a loss. From the 61st product onwards, you make a profit in the amount of the unit contribution margin of the product sold, as your fixed costs are already covered.

If you plot your ratio of clicks to your profit, you can see the relationship as a straight line that leaves the loss zone at exactly 4,000 clicks.

The magic limit at which you have covered all costs and realized profits is also known as the break-even point and the calculation is called break-even analysis. This is a simple but powerful tool for gaining an overview of your company. It is characteristic of the break-even point that the sales volume is always calculated for a profit of €0. However, you can also use any other value as the target profit and determine your sales volume for this. For example, if you want your website to generate €4,000 in profit, you would have to achieve approx. 164,000 clicks according to our equation.

Such an analysis also shows you whether your current concept is really viable to generate a realistic income or whether you need to expand your offer. What does this mean? If you come to the conclusion that your project is not profitable, you need to assess whether you can influence individual variables. For example, you could increase your prices or look for a cheaper provider where you have to pay less for server rental and costs per click, or you could try to encourage your customers to buy more from your website.

As already mentioned at the beginning, the example is a very simplified representation, both in terms of figures and analysis, but also, for example, the neglect of taxes and duties. If you are interested in this topic in more depth and want to look at a realistic example, the terms standard costing, activity-based costing and target costing will be of interest to you. However, the approach shown here and what you will find under these terms have one thing in common: they will help you to make decisions on business issues.

Thanks to similar analysis and cost comparisons, we at WeValCo, for example, have decided to build our own scalable IT infrastructure based on open source technology and have moved away from more expensive complete solutions from large manufacturers. This means that we save around a factor of five on costs, but have to maintain the infrastructure ourselves and develop our own support programs. In a comprehensive cost calculation, the costs for development and maintenance would of course have to be offset against the lower purchase prices.

However, this brief digression is intended to show you that this method highlights decision options that you need to weigh up in a further step, taking into account relevant objectives. We will show you how to deal with conflicting goals and what good tools there are for making decisions in a later blog post. With regard to this method, it should be noted that this analysis is not a miracle cure, but can show you whether the additional effort is financially worthwhile for you.

The target cost calculation

The figures from the example with your website were previously based on statistics from your web analytics tool and therefore on values from the past. From this, we knew that you book an average of 15 sales per 1,000 clicks. However, we also know that the past is not always a good indicator of the future and that we want to base our investments on what is expected in the future.

One way to better plan for the future is to use target costing. Based on your processes, experience and information, you estimate the future costs and associated break-even quantities that you will incur in the coming month or market. This can help you to avoid unpleasant surprises and supports you in costing your products and services.

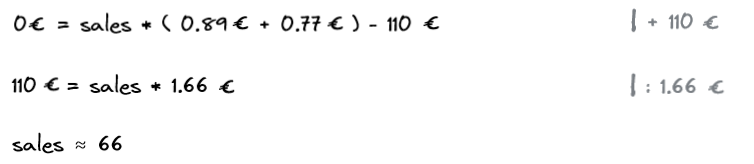

If, for example, you assume that prices in purchasing will be 5-10% higher based on the latest news about rising inflation, you can plan for this and react accordingly and adapt your analysis to the new circumstances. If you assume that your server costs will rise from €100 to €110, you can take this into account in your calculation and arrive at the following result:

You can see that, all other things being equal, you need to sell around 6 more products to compensate for the increase in your server rental costs. This gives you a basis for deciding whether your sales prices are still realistic and sustainable, or whether you need to adjust them if necessary. You can use the method shown here as a guide to calculate which cost corridor is acceptable for you and your company.

To improve your calculations, it helps to carry out an actual cost calculation as a check after the target cost calculation. In this, you check which costs have actually been incurred and in what amount. This helps you to compare how good your forecasts were and to continuously improve them as an iterative process. This will show you, for example, that you tend to overestimate the expected changes and that your server costs have increased, but only to €105. This knowledge helps you to better forecast the future and keep your analysis as accurate as possible. However, you must also bear in mind that even all the measures taken together are no guarantee of completely avoiding losses or inefficient processes.

Conclusion and outlook

In this article, we have looked at what costs are and how they can affect your business. We have also looked at how you can determine your variable costs, contribution margins and break-even quantities and how these analyses can help you make decisions. We also looked at how you can deal with changes in the future to keep your analysis flexible and adapt to the environment.

Knowing your costs and associated processes is all the more important the closer you are to being in the red. This is where cost accounting helps you to identify the cause of losses and determine their extent in order to eliminate them sustainably. But even if you are planning to create a completely new product or serve a new market with which you have no experience, a cost calculation will help you to make initial forecasts and decide whether planned steps can be profitable.

Share your experiences or ask us your questions about pricing! Leave a comment or discuss with us on X or LinkedIn.